2022 tax brackets

Your bracket depends on your taxable income and filing status. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

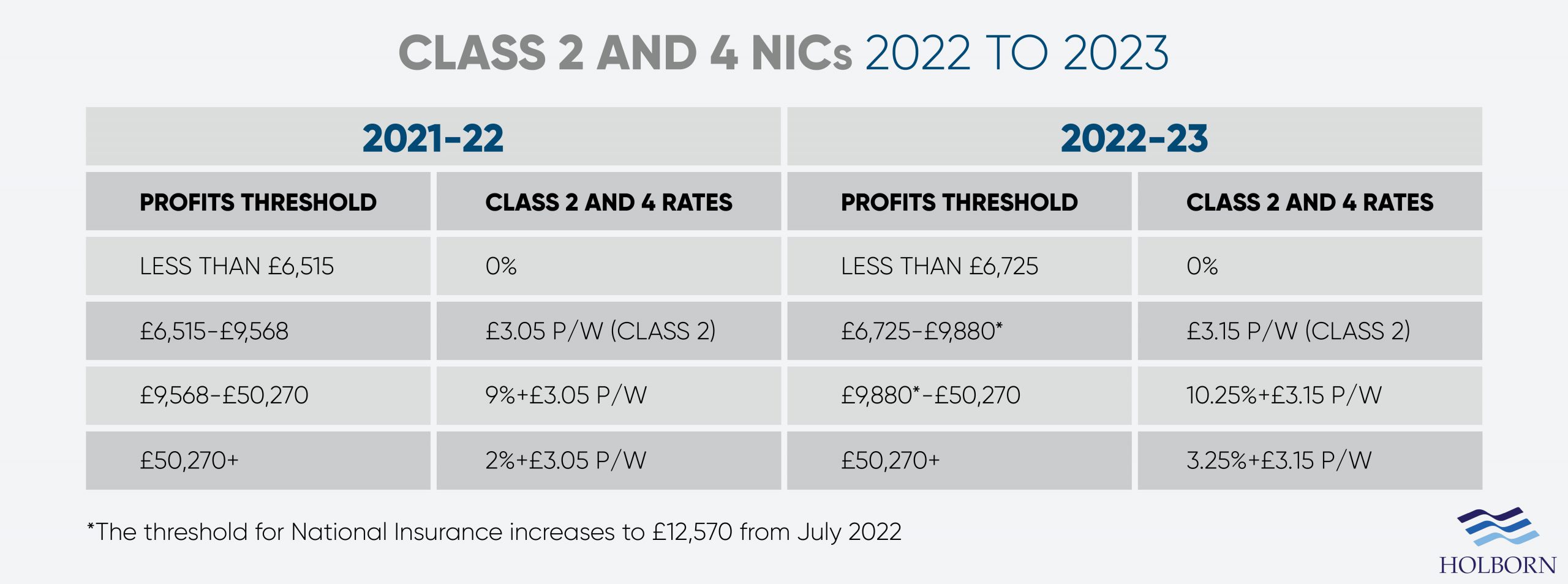

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household.

. 20 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. There are seven federal income tax rates in 2022. The agency says that the Earned Income.

2022 Tax Bracket and Tax Rates There are seven tax rates in 2022. Resident tax rates 202223 The above rates do not include the Medicare levy of 2. Based on your annual taxable income and filing status your tax bracket.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. Ad Free federal filing for all US tax brackets simple and complex returns. The 2022 tax brackets affect the taxes that will be filed in 2023.

10 announced new tax brackets for the 2022 tax year for taxes youll file in April 2023 or October 2023 if you file an extension. Residents These rates apply to individuals who are Australian residents for tax purposes. Here are the new brackets for 2022 depending on your income and filing.

Heres how they apply by filing status. There are seven tax brackets. The 2022 and 2021 tax bracket ranges also differ depending on your filing status.

There are seven federal tax brackets for the 2021 tax year. 1 day agoForty-year high inflation has driven up the standard deduction for 2023 as well as the tax brackets earned income tax credit and more. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

2022 tax brackets Thanks for visiting the tax center. Federal Income Tax Brackets for 2022 Tax Season. To access your tax forms please log in to My accounts General information.

10 12 22 24 32 35 and 37. Discover Helpful Information And Resources On Taxes From AARP. 22 hours agoHigher standard deduction The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022.

Below you will find the 2022 tax rates and income brackets. The top marginal rate or the highest tax rate based on. 37 for individual single taxpayers with incomes greater than 578125 693750 for.

Income Tax rates and bands. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals. The IRS on Nov.

These are the rates for. A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes.

The top marginal income tax rate. Up from 20550 in 2022. 17 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000.

1 day agoBelow are the new brackets for both individuals and married coupled filing a joint return. Remember these arent the amounts you file for your tax return but rather the amount of tax youre going to pay starting January 1 2022. Ad Compare Your 2022 Tax Bracket vs.

In the American tax system income tax rates are graduated so you pay different rates on different amounts of taxable income called tax. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year.

How the brackets work. E-File directly to the IRS maximum refund guaranteed. Your 2021 Tax Bracket To See Whats Been Adjusted.

Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. The current tax year is from 6 April 2022 to 5 April 2023. Here are the 2022 Federal tax brackets.

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of. 1 day agoThe IRS is boosting tax brackets by about 7 for each type of tax filer such as those filing separately or as married couples. These are the 2021 brackets.

10 12 22 24 32 35 and 37. Single tax rates 2022 AVE.

Changes To Uk Tax In 2022 Holborn Assets

Ato Tax Time 2022 Resources Now Available Taxbanter

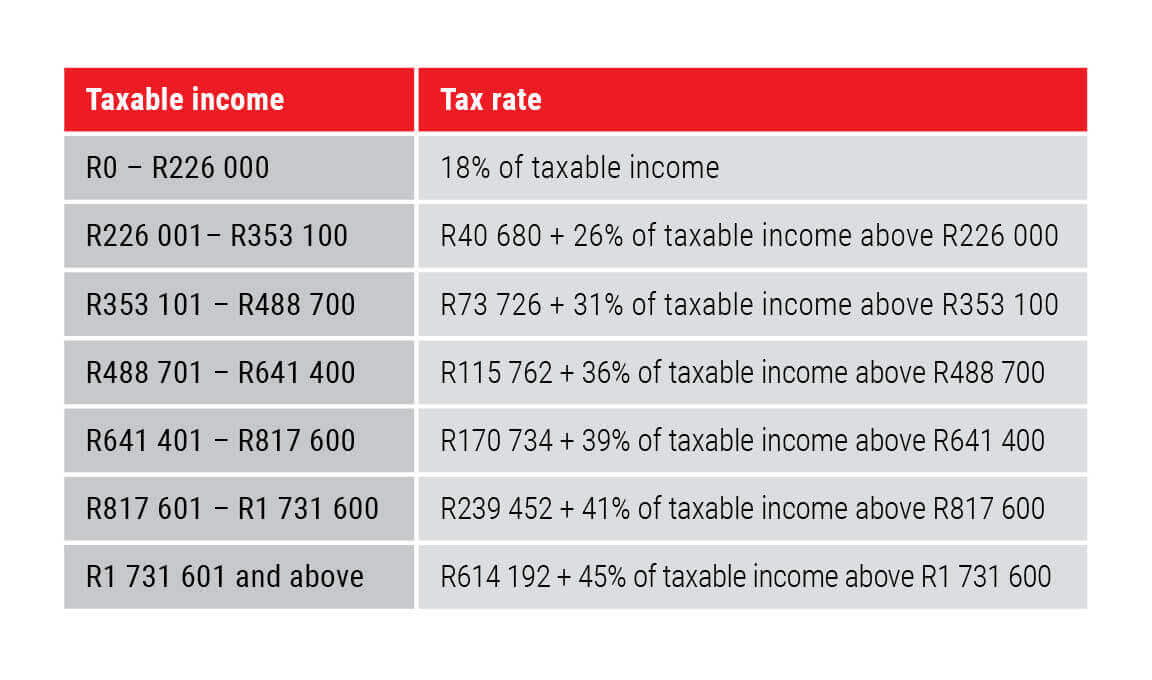

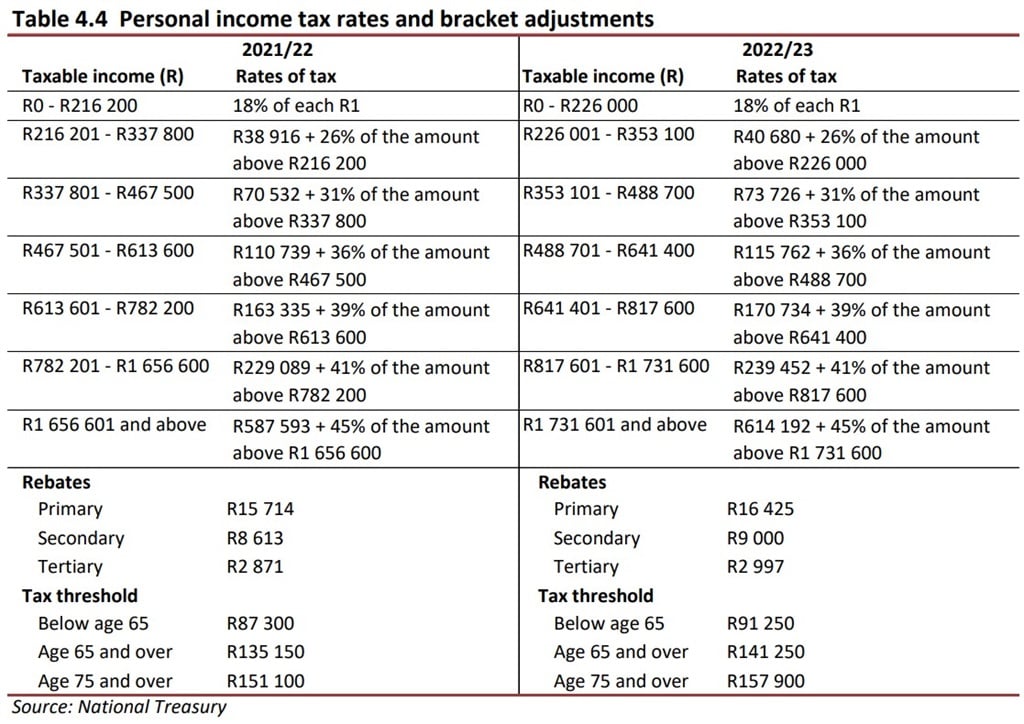

Allan Gray 2022 Budget Speech Update

Inflation Pushes Income Tax Brackets Higher For 2022

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

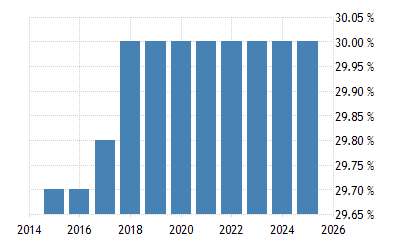

Germany Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

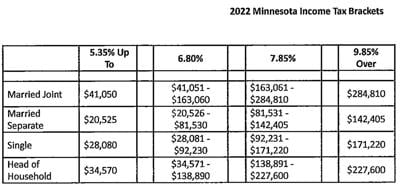

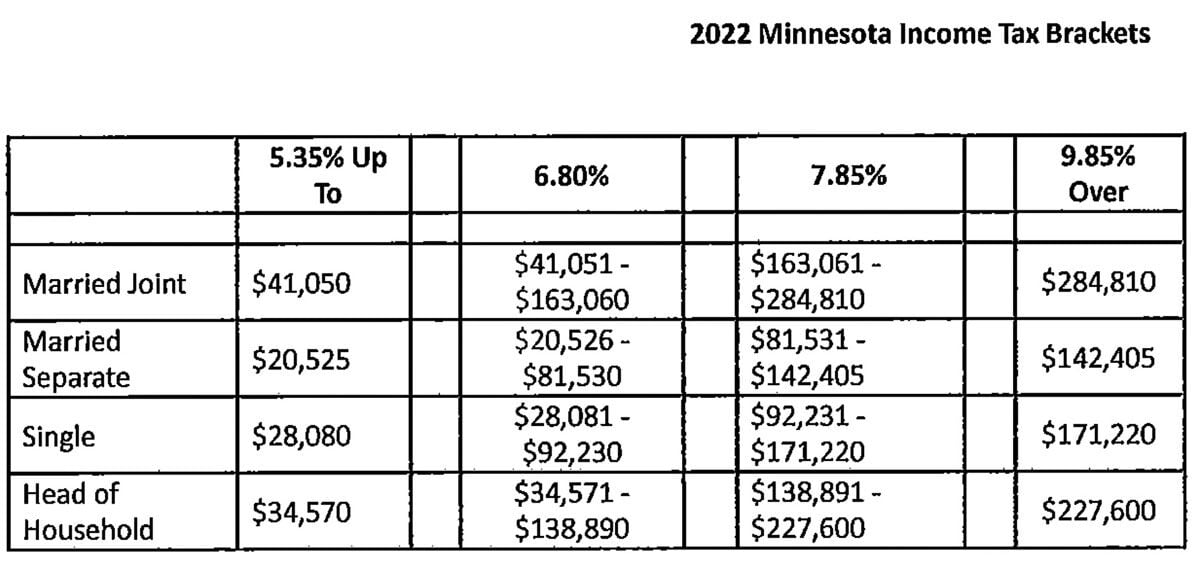

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

New 2022 Tax Brackets Ckh Group

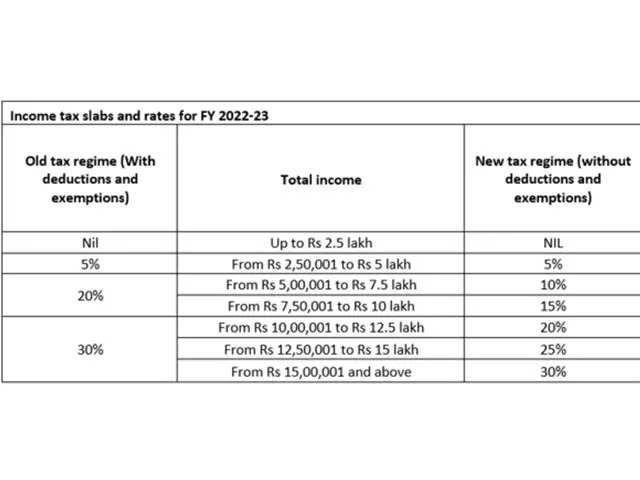

Budget 2022 Maintains Status Quo On Income Tax Rates Taxpayers Pay As Per These Slabs No Change In Personal Income Tax Slabs The Economic Times

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

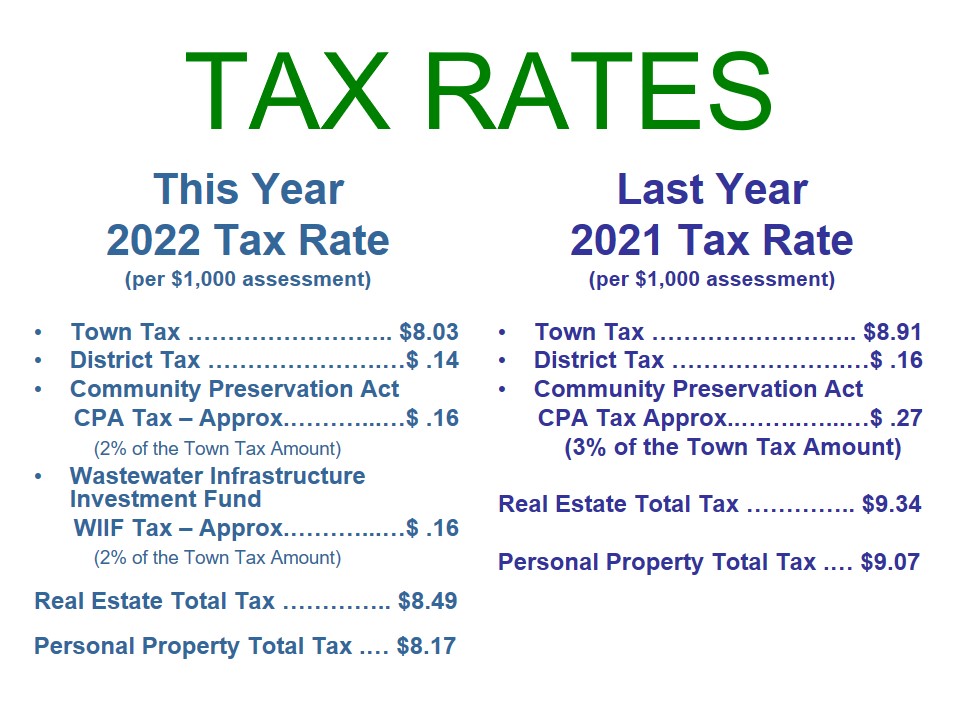

Fiscal Year 2022 Tax Rate Town Of Mashpee Ma

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

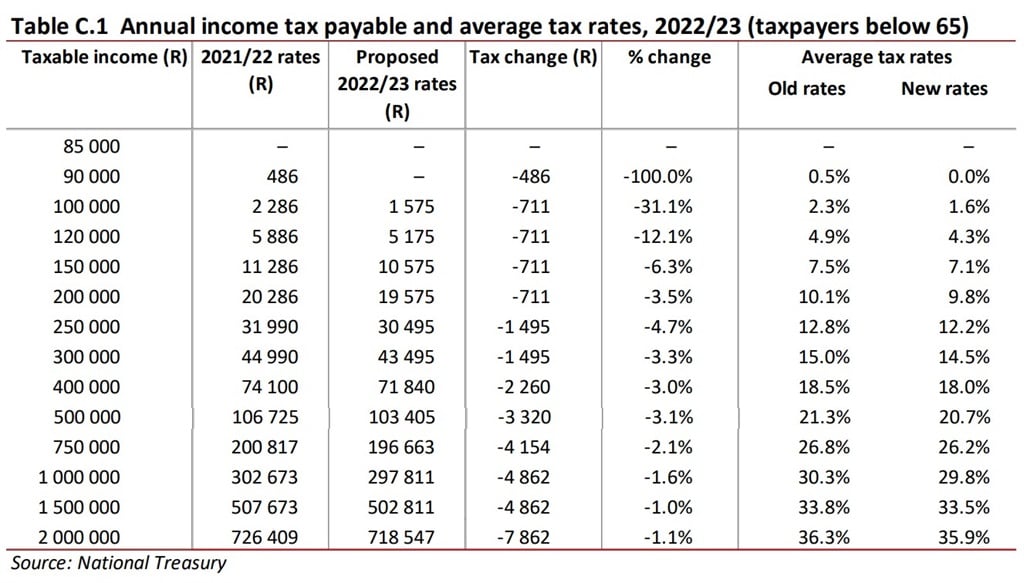

Budget 2022 Tax Relief These Are All The Big Changes Fin24

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

Budget 2022 Tax Relief These Are All The Big Changes Fin24